1. Everyone, the Lessman here for Money Evolution Calm. In today's video blog, I want to talk about something I call the pension double dip strategy. 2. We're located here in Michigan, outside of Detroit, and we have a lot of automotive clients - a lot of people that work for GM or Chrysler and like a lot of companies for GM and Chrysler have all frozen their pension plan. 3. So, what that means essentially is that many of these people are not getting any further pension benefits. In other words, their pensions are locked in place right now. 4. What's more is that some of these companies allow them to begin collecting their pension benefits as early, in some cases, as age 58 and have them be unreduced. 5. In other words, they're gonna get the same amount at age 58 that they would get even if they waited all the way until age 65. So, there's really no benefit for them to work those additional seven years in terms of what they could collect from their pension. 6. And again, some of these companies also offer something we refer to as the Social Security pension bridge. 7. What that means essentially is that if they retire prior to age 62, which is the earliest age that you can begin collecting Social Security benefits, they're gonna give you a supplemental pension. Usually, it's between $800 and as much as $1200 a month that you're going to get every month in those months prior to you turning age 62. 8. So that adds up to a lot of money. So what we've had a lot of clients do here is they actually retire from one company, they turn that pension benefit on, let's say at age 58, and then...

Award-winning PDF software

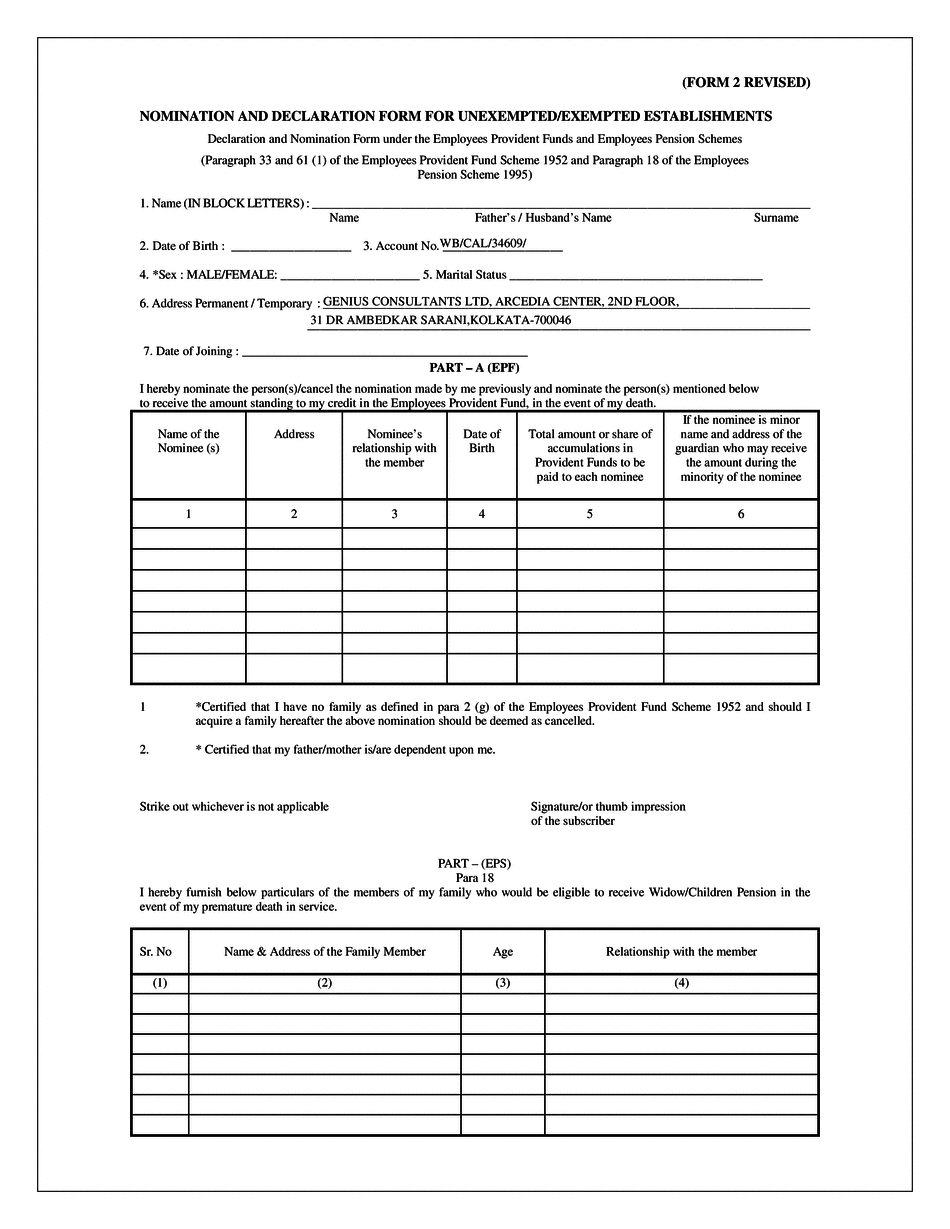

Pension nomination 2 Form: What You Should Know

It requires the nominee to fill a declaration form with the information given at his appointment. It also requires the nominee to fill his PF form 2. Form 2- Declaration and Nomination, Form 2- Nomination and Form 2-PF Declaratory Sep 25, 2025 — In case an employee has already filed the EPF Form 2 for any of the employees as his personal nominee before the end of the fiscal year-end, this nomination should not be made, as the Form 2 is mandatory for the company-s Employees to have a claim in case of death, disability, transfer, retirement of the employee, leave, suspension or any other reason. For the employees to have a PF claim, this form is made on their personal accounts of the company. The form is mandatory for the EPF nomination and declaration of the nomination(BS) which was done in 2015. PANAMA DECLARATION. PANAMA DECLARATION FORM (PANAMA) Sep 25, 2025 — In case an employee has already filed the Form 2 for a previous employee as his personal nominee under the EPF, PF or any of the other schemes, this nomination should not be made, as the form is mandatory for those who have resigned as their personal nominee before the end of the fiscal year-end.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 2 Revised, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 2 Revised online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 2 Revised by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 2 Revised from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Pension Nomination Form 2