Award-winning PDF software

Form 2 Revised for Portland Oregon: What You Should Know

Form 134 and it was not appealed. State of Oregon: Forms — Forms library Payroll Taxes — Tax Forms and Fliers Portland: Forms — Forms and publications library PORTLAND TAX EXEMPTIONS. Inherited or Obligated Dependent Tax Exemption Under the laws of the State of Oregon, children of military personnel or their dependents are automatically exempted from certain Oregon corporate income taxes. The child is either considered an “inherited” or an “obligated” dependent of the military person or the dependent has died, but the child survives or was adopted. See the Oregon Military Dependents Tax Exemption (PDF, 888kb). State of Oregon: Forms — Forms and publications library Employee and Employer Tax Exemptions Unmarried couples filing joint return can exclude up to a total 20,000 (the total of tax paid on one spouse and an amount of federal credits or deductions on the other spouse) in employee and employer deductions. The exclusion applies solely to employees and employers whose wages do not exceed 100,000 and who do not file a joint federal return. State of Oregon: Forms — Forms and publications library The Federal Contribution to Retirement Programs Tax Exemption On the basis of certain eligibility requirements, the Federal employee and Federal contractor retirement programs are exempt from tax. Federal employee and Federal contractor retirements are limited in the amount that may be excluded from income. For details, see the Federal Programs Not Taxed (PDF, 15kb). State of Oregon: Forms — Forms and publications library STATE EMPLOYEE AND EMPLOYER RETIREMARKET BENEFITS These programs are subject to a different, non-refundable State income tax withholding and filing requirement. The following benefits do not affect income tax withholding, withholding is not required for eligibility and the federal matching funds may be deposited back into your regular Oregon State retirement program. State of Oregon: Forms — Forms and publications library COMPOSITION OF TAX PAYMENTS Oregon tax is based on personal income, employment status, and the size of your tax bracket. Personal income applies to both wage-earning workers who are required to file annual income tax returns and other dependent workers. The personal income tax rate of 4% is the same regardless of whether you are single, married, or divorced.

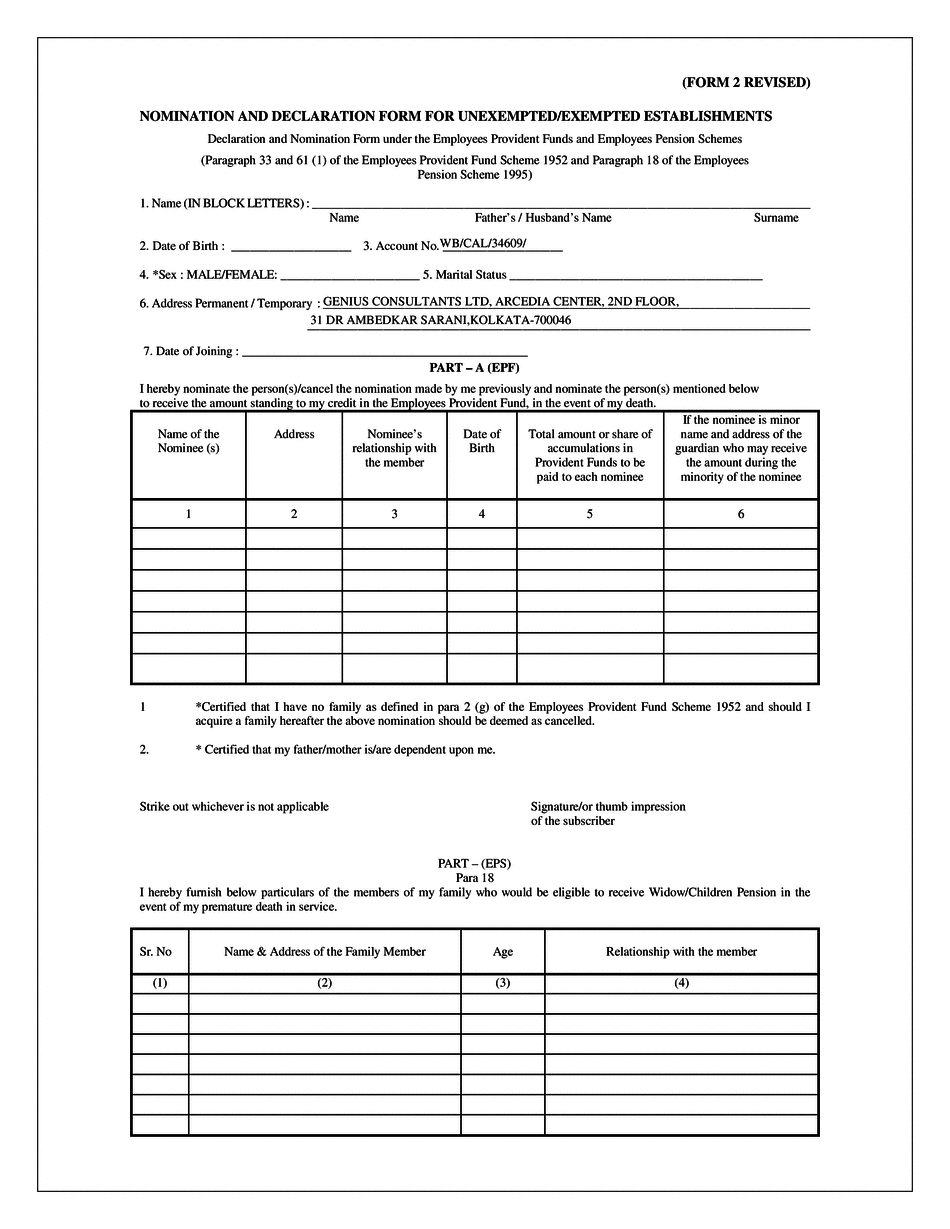

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 2 Revised for Portland Oregon, keep away from glitches and furnish it inside a timely method:

How to complete a Form 2 Revised for Portland Oregon?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 2 Revised for Portland Oregon aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 2 Revised for Portland Oregon from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.