Award-winning PDF software

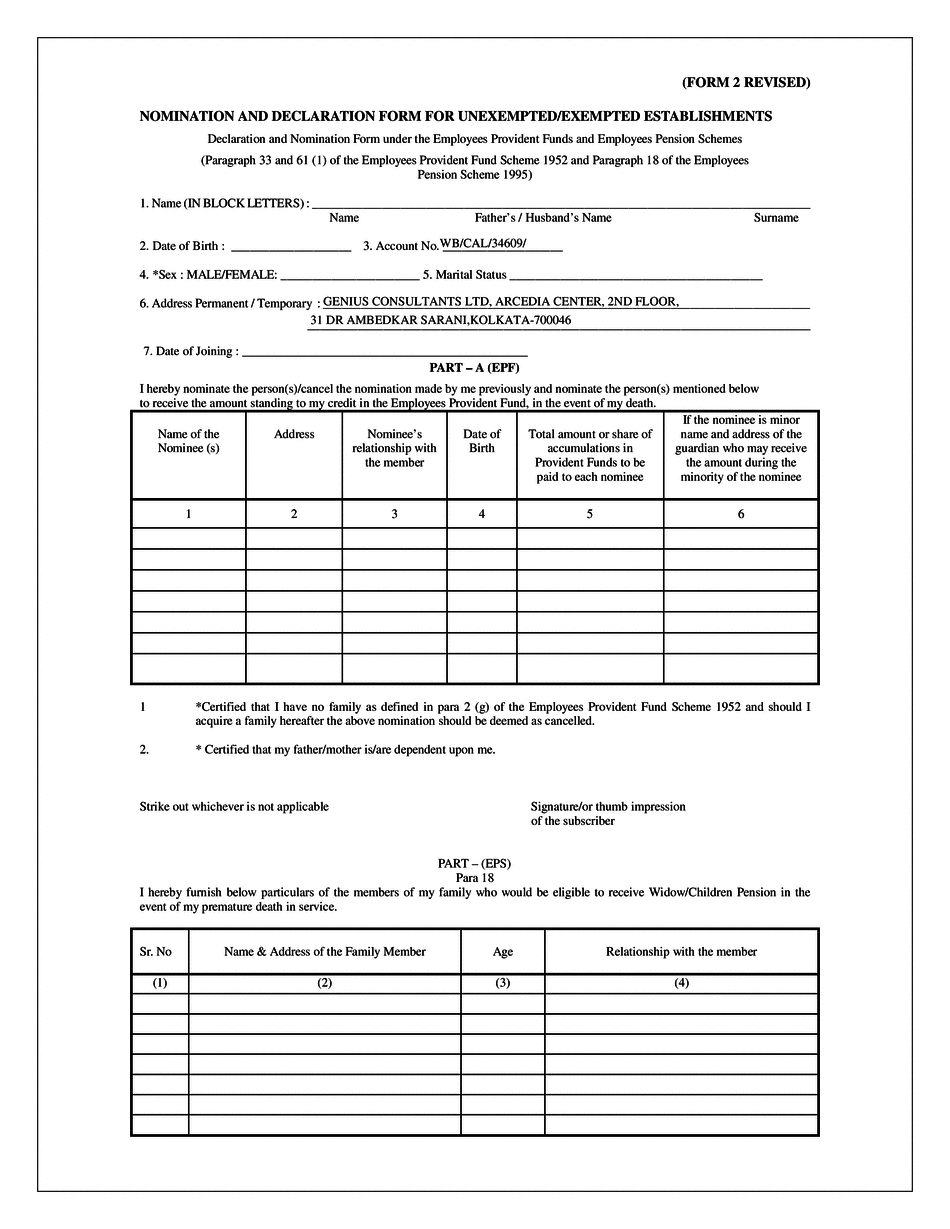

Form 2 Revised Irving Texas: What You Should Know

It focuses on ensuring that each child receives the services that are both appropriate and necessary to meet the individual needs of each child. A Certificate of Eligibility and Certificate of Services (CCSS) have to be completed by each family member. The State of Texas requires the PCI program within the Defining Springs Independent School District to obtain written informed consent prior to providing any services to children of any age, including children under 3 years. This consent must be filed with the PCI Administrator within ten (10) days after any services are rendered. If you have any questions about this process, please contact PCI Administration at a.difuniakdifuniak.net. This is for the entire Defining Springs Independent School District. If you are a teacher or administrator working for Defining Springs Independent School District please contact the Defining Springs Independent School District Department of Instruction and Education Tax Rate Increase, 2018-19 Tax Rate Increase, 2018-19 Defining Springs Independent School District: Effective October 1, 2018, the County of Irving will adjust the school tax from 945.00 to 945.00 for each taxable family. For tax year 2018-19, the City of Irving will impose an increase of 7.95 to the school tax (the increase is to be adjusted for adjustments made to the State Education Agency Education Funding formula in April 2018). Irving Independent School District: Taxes will be raised 30 to 40 per 100 of taxable value for tax year 2019-20 due to ongoing inflation. All funds will be returned to the City of Irving, including all property taxes currently due and payable prior to July 1, 2017. The increase will affect both Irving Independent School District and District of the Lake. IRVING INDEPENDENT SCHOOL DISTRICT Tax Rate Increase, Effective Oct 1, 2018 Effective Oct 1, 2018, the County of Irving will increase the per-student public school tax levy from 900.00 to 2125.00 for each tax year beginning in 2019-20. This increase will bring the Irving School Tax in line with the countywide school levy for the entire school year 2019-20. Irving Independent School District: Beginning in 2018-19, the fee for each school student will be increased from 600.00 to 600.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 2 Revised Irving Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 2 Revised Irving Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 2 Revised Irving Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 2 Revised Irving Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.