Award-winning PDF software

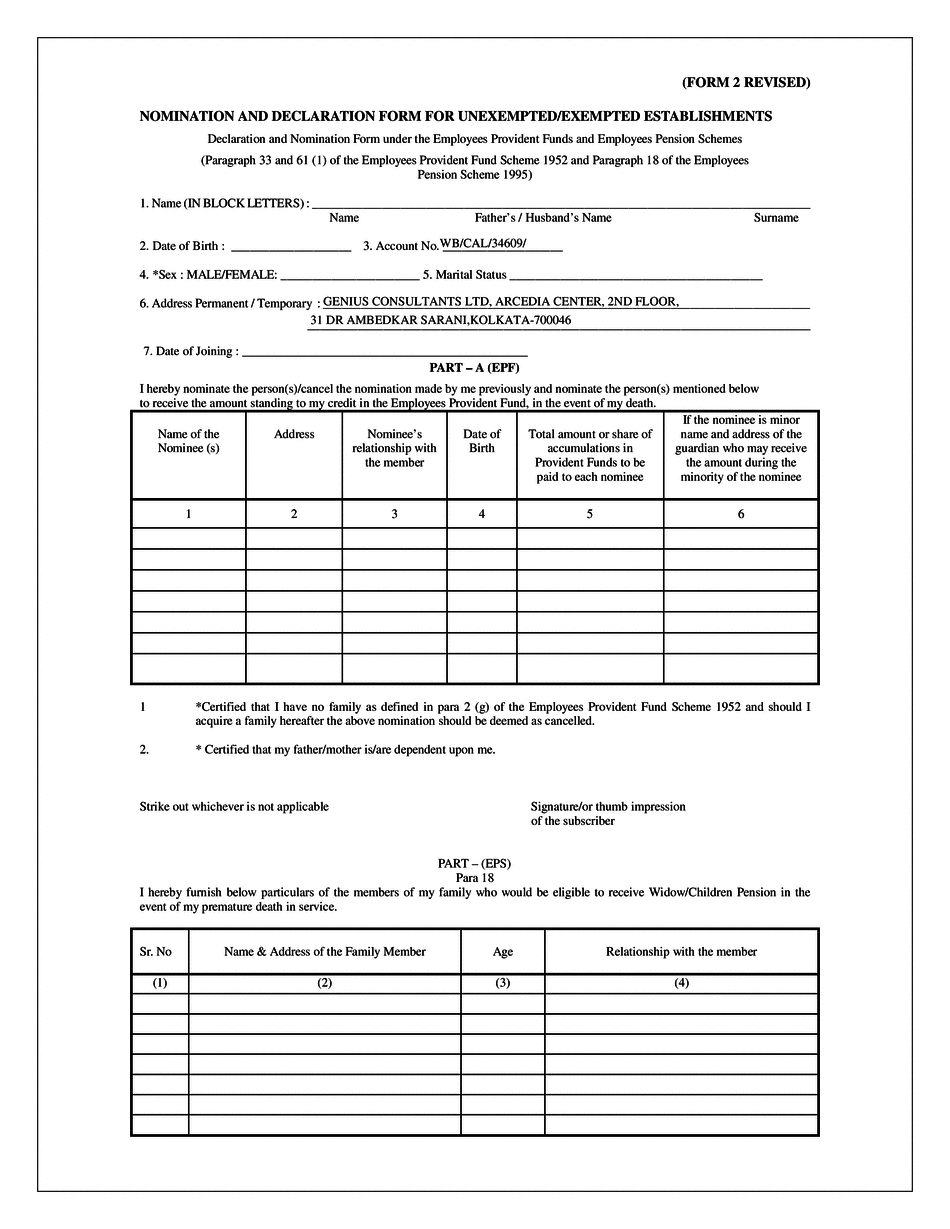

Form 2 Revised online Chattanooga Tennessee: What You Should Know

Take these documents and pay any service fee (6.75) before submitting the form. If you have questions, please contact. If you have any questions or need help completing the form, contact a Chattanooga tax collector. Forms and processes — Hamilton County Clerk Pay property taxes online with tag and title services at the Hamilton County Clerk Office, located at 1805 McDowell Ave. Tag and Title Services is a free service offered by the Hamilton County Clerk's office. We're dedicated to helping citizens pay property taxes online and have you back online in minutes. The office will provide you with form to create an electronic payment. Cash and check are accepted. The Clerk's Office will mail your payment using money order or cashier's check, and an e-check will also be processed using your payee's e-mail address. (To avoid mail delays or incorrect information provided by your payee, make sure that the payment is completed with the correct information.) The property tax bill will be mailed within 4-6 weeks after payment is received. If the property tax is still delinquent, the property will be placed in tax lien until payment is made in full. Once the property tax is paid, the lien will be released. Tax lien must be paid before you may receive a notice in the mail from the Department of Revenue. We are able to use your PayPal account, and you will need to have your email address. If you do not have an email address please visit the Tennessee Taxpayer website and input your name and mailing address. The Department of Revenue will send you email confirmation of your payment once your payment is finalized. Incoming Calls: Toll Free: Please refer to the Taxpayer's Guide at the link above that contains the information on filing and paying taxes, or contact us at. The tax payment must be complete before we can confirm your tax payment information. You are welcome to visit us. You may use our services at any time, whether you wish to file your tax return electronically or by mail, or if you need assistance in understanding your tax bill please do not hesitate to contact our office. We will do everything we can to assist in your tax situation. Tax Payment Form in Spanish.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 2 Revised online Chattanooga Tennessee, keep away from glitches and furnish it inside a timely method:

How to complete a Form 2 Revised online Chattanooga Tennessee?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 2 Revised online Chattanooga Tennessee aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 2 Revised online Chattanooga Tennessee from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.